HELOC Tips: Pros and Cons for Your Financial Success Plan

A Home Equity Line of Credit (HELOC) can be a

powerful financial tool, offering homeowners access to funds for major

expenses, home improvements, or even debt consolidation. But is it the right

move for your financial success plan? Let’s explore how HELOCs work, tips

for using them wisely, and their pros and cons.

What is a HELOC?

A HELOC is a revolving line of credit that allows

homeowners to borrow against the equity in their home. Unlike a traditional

loan, where you receive a lump sum, a HELOC works like a credit card—you can borrow,

repay, and borrow again up to your approved limit during the "draw

period" (usually 5-10 years). After that, the repayment period (typically

10-20 years) begins, where you can no longer borrow and must start paying back

the principal and interest.

Smart HELOC Tips

If you're considering a HELOC, follow these best practices

to maximize benefits and minimize risks.

✅ 1. Borrow Only What You Need

Since a HELOC is a revolving credit line, it’s tempting to

use it for non-essential expenses. Instead, use it strategically for high-value

investments like home renovations, education, or consolidating

high-interest debt.

✅ 2. Understand Variable Interest

Rates

Most HELOCs have variable interest rates, meaning

your monthly payments can fluctuate. Be sure you understand how rate changes

could impact your finances, and consider a lender that offers rate caps or

fixed-rate conversion options.

✅ 3. Avoid Over-Borrowing

Just because you have access to a large credit line doesn’t

mean you should use all of it. Borrow only what you can afford to repay to

avoid financial strain and risking foreclosure.

✅ 4. Create a Repayment Plan

Unlike a traditional loan with fixed monthly payments, a

HELOC may have low initial payments, but the repayment phase can be costly.

Set up a structured plan to pay off the balance before the repayment period

begins.

✅ 5. Watch for Fees & Hidden

Costs

Some HELOCs come with annual fees, early termination

fees, or transaction charges. Read the fine print and compare lenders to

find the best terms.

✅ 6. Use It for Wealth-Building,

Not Lifestyle Spending

Using a HELOC to finance vacations, luxury purchases, or

everyday expenses can lead to debt problems. Instead, focus on investments

that improve your financial future, like upgrading your home, paying for

education, or consolidating high-interest debt.

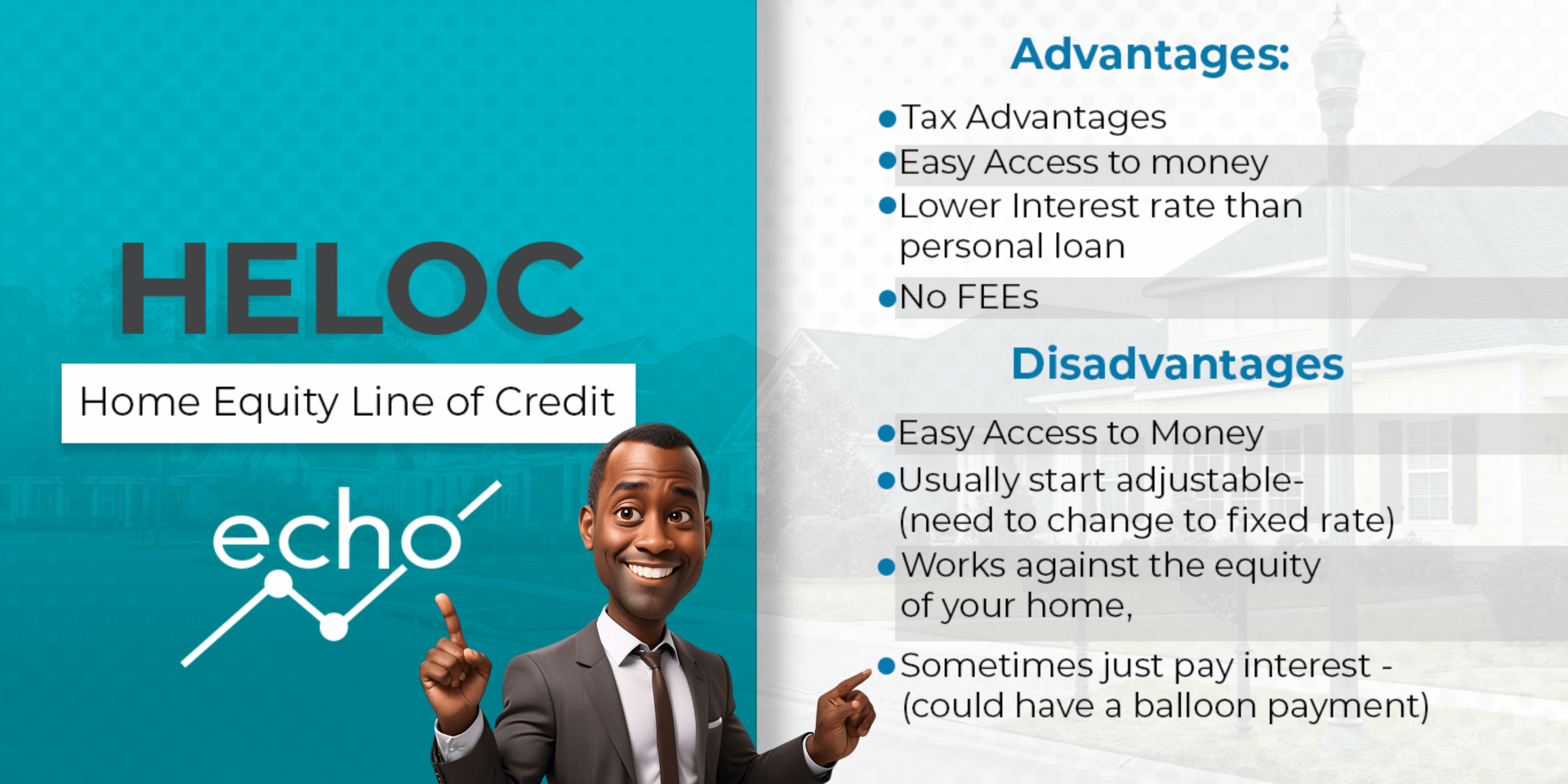

Pros & Cons of a HELOC for Financial Success

✅ Pros of a HELOC

✔ Low Interest Rates:

Since a HELOC is secured by your home, it typically has lower interest rates

compared to credit cards or personal loans.

✔ Flexibility: You can borrow

as needed rather than taking out a lump sum, making it a flexible financial

tool.

✔ Tax Deductibility: If

used for home improvements, HELOC interest may be tax-deductible (check

with a tax professional for details).

✔ Debt Consolidation Tool:

A HELOC can help you pay off high-interest debt like credit cards,

saving you money in the long run.

✔ Increase Home Value:

Using HELOC funds for renovations or upgrades can boost your home’s

market value.

❌ Cons of a HELOC

❌ Your Home is Collateral:

If you miss payments, you risk foreclosure—a major downside to consider.

❌ Variable Interest Rates:

Payments can increase if interest rates rise, making repayment unpredictable.

❌ Temptation to Overspend:

Easy access to credit can lead to unnecessary borrowing and financial

strain.

❌ Market Fluctuations: If

home values drop, you could end up owing more than your home is worth

(negative equity).

❌ Fees & Closing Costs:

Some lenders charge appraisal fees, closing costs, or maintenance fees,

adding to the overall cost.

Is a HELOC Right for You?

A HELOC can be an excellent financial tool when used

responsibly, but it’s not for everyone. If you’re disciplined with debt and

have a clear repayment strategy, it can help you achieve financial goals

like home improvements, education, or debt reduction. However, if you’re at

risk of overspending or struggling with debt, a HELOC could create more

financial challenges than benefits.

Final Thought

Before taking out a HELOC, consider your long-term financial

goals, repayment ability, and market conditions. Used wisely, it can be a

stepping stone to financial success—but mismanaged, it can become a financial

burden.

???? Think strategically,

borrow responsibly, and plan ahead to make a HELOC work for you! ????

Invite Friends & Colleagues

Post On