Refinancing Your Home: Advantages, Disadvantages, and When It’s BeneficialRefinancing your home can be an appealing option for many homeowners looking to take advantage of lower interest rates, tap into home equity, or change their loan terms. However, like any financial decision, refinancing ...

Details

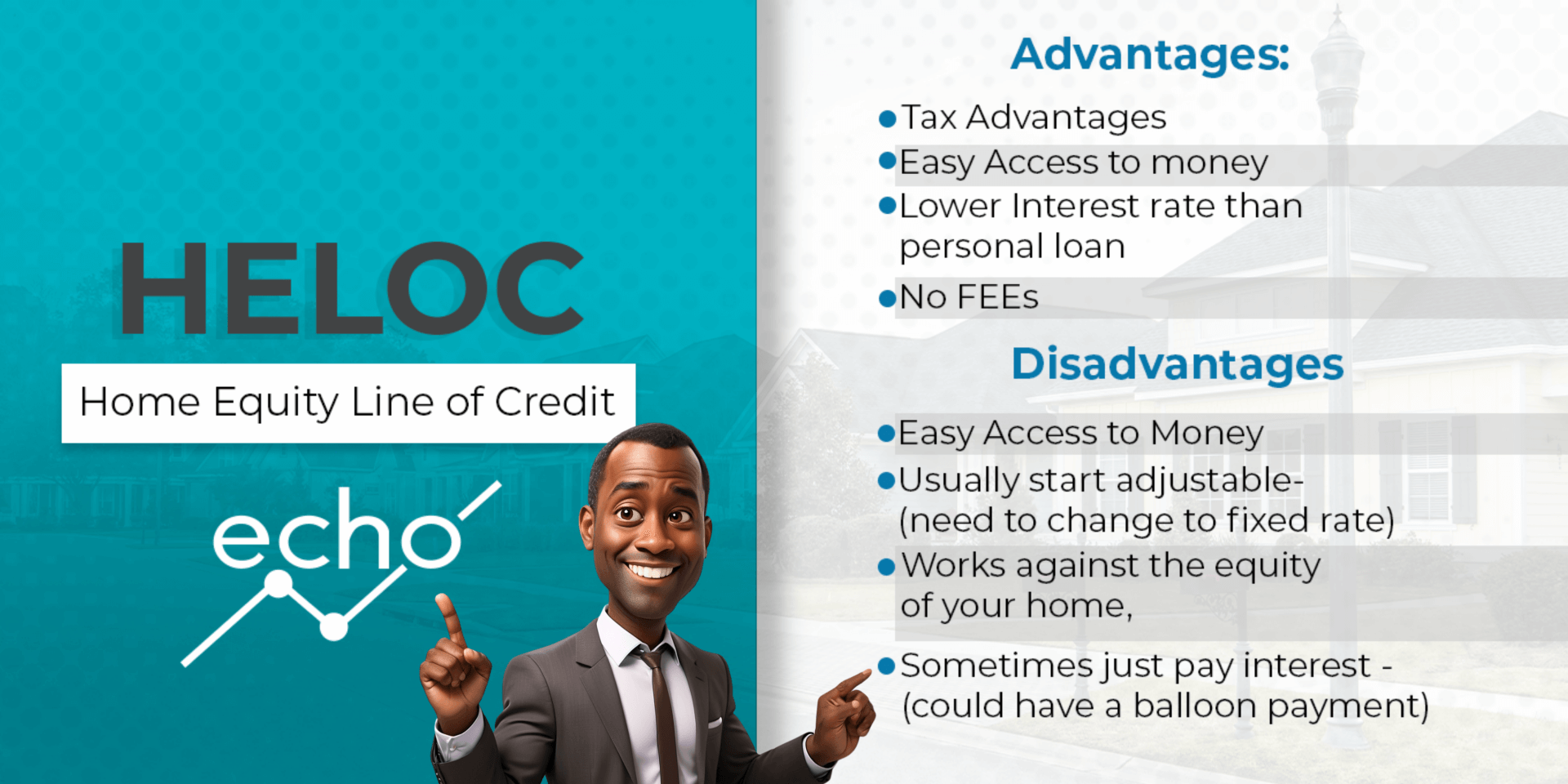

HELOC Tips: Pros and Cons for Your Financial Success PlanA Home Equity Line of Credit (HELOC) can be a powerful financial tool, offering homeowners access to funds for major expenses, home improvements, or even debt consolidation. But is it the right move for your financial success plan? Let’s ...

Details

The Social Security Administration: Understanding Its Role and How to Work with Them The Social Security Administration (SSA) plays a crucial role in the lives of millions of Americans. Whether you’re approaching retirement, applying for disability benefits, or seeking assistance for family ...

Details

One of the most basic principles of investing is to gradually reduce your risk as you get older since retirees don’t have the luxury of waiting for the market to bounce back after a dip. The dilemma is figuring out exactly how safe you should be relative to your stage in life. Read More: htt...

Details

Welcome to Echo InvestingHello and welcome! We’re so excited to share Echo Investing with you—a groundbreaking Ohio-based fintech startup that’s here to completely reshape the way you think about investing. The Echo Investing app will launch to the public in the Fall of 2024, and we can’t wa...

Details

How Echo Investing Works: Transform Your Financial FutureInvesting isn't easy. Did you know that 70% of individual investors lose money each year? This statistic is alarming, especially as we face the greatest wealth transfer in history. Echo Investing is here to change the narrative. We're bringing...

Details

Investing Tips for Beginners: How to Start Investing Like a ProInvesting can feel overwhelming when you’re a beginner, but it doesn't have to be. With the right knowledge and approach, anyone can start building wealth through investing. Here are some essential tips to guide you on your journey:1. ...

Details

Investing often gets painted as a solo mission, but the truth is that being social and communicative can seriously boost your success. Whether you’re just starting or you’ve been trading for years, here’s why connecting with others can make a big difference:1. Gaining Fresh PerspectivesTalking...

Details

Investing can feel overwhelming, especially with the sheer volume of strategies and opinions. However, understanding a few key principles can simplify the process and enhance your chances of success. This post will explore four effective strategies: Buy-and-Hold, Dollar-Cost Averaging, Diversificati...

Details

Become an Echo Expert: Grow Your Reach and Revenue in FinanceIn finance, influencers and stock investors have a unique window of opportunity to grow their impact and income. If you’re a financial expert ready to take your brand further, becoming an Echo Expert could be your next step. Here’...

Details

Investing doesn’t have to feel overwhelming. But with so much noise, it’s easy to fall for ideas that can stop you from growing your wealth. Let’s break down five big investing myths and the truth behind them—so you can move forward with confidence.1. Is Investing in Stocks Just Gambling? No...

Details

Investing in 2025: How Anyone Can Start with Just $1 Investing can often seem intimidating, especially when financial experts talk about needing six-figure savings to secure a comfortable retirement. Many people assume that the stock market is only for the wealthy or those with large amounts of...

Details

Breaking Free from the Paycheck-to-Paycheck Cycle: The Power of Financial Literacy Living paycheck to paycheck is a reality for millions of Americans, even those earning six-figure incomes. The Survey of Consumer Finances reveals a surprising statistic: only 1% of families earning over $100,000...

Details

How to Build Credit: A Step-by-Step Guide to Achieving Your Financial GoalsYour credit score is more than just a number—it’s a key factor in your financial life. This three-digit figure helps lenders determine your creditworthiness, impacting your ability to qualify for loans, credit cards, ...

Details

How Smart Credit Card Use Can Boost Your Financial Success Credit cards often get a bad reputation for leading to debt and financial struggles, but when used wisely, they can actually be a powerful tool for financial success. A well-managed credit card can help build credit history, improve you...

Details

Understanding Liens: How They Can Impact Your Financial Success A lien is a powerful legal claim that can have major financial consequences for individuals and businesses. Whether you’re buying a home, applying for a loan, or trying to build financial stability, understanding liens is crucial...

Details

Understanding FICO Scores: How They Impact Your Financial SuccessYour FICO score is one of the most important numbers in your financial life. It determines your ability to qualify for loans, secure low-interest rates, and build financial stability. Whether you're applying for a mortgage, auto lo...

Details

Credit Privacy & Identity Theft: Protecting Your Financial FutureIn today’s digital world, credit privacy and identity theft are major concerns for individuals and businesses alike. Identity theft can have devastating financial consequences, affecting your credit score, loan eligibility, a...

Details

Creating a Nest Egg: Financial Success Starts with Smart Savings and DiversificationBuilding a nest egg is a fundamental part of achieving financial success and security. Whether you’re planning for retirement, an emergency fund, or future goals, having a nest egg provides peace of mind and th...

Details

Understanding the Time Value of Money: Why Now Is Almost Always BetterCongratulations! You’ve just won a cash prize and have two payment options: Option A: Receive $10,000 today. Option B: Receive $10,000 three years from now. Which option would you choose?For most people, the i...

Details

New Car vs. Used Car: Which is the Better Financial Decision?Buying a car is one of the most significant financial decisions you'll make in your lifetime. Whether you’re considering a brand new car or a used one, understanding the financial implications of each option is essential for achievin...

Details

Home Insurance Check-Up: Keeping Your Financial Plan on PointYour home is one of the largest investments you'll ever make, so protecting it with the right home insurance policy is essential. However, just like other aspects of your financial plan, your home insurance shouldn’t be something you...

Details

How Much House Is Too Much? Deciding on the Right Size for Your First Home and Financial EmpowermentBuying your first home is an exciting milestone that marks a huge step in achieving financial stability and independence. However, when it comes to selecting the right size home, it can be easy to ...

Details

Why Every Successful Financial Plan Must Include Life InsuranceA truly successful financial plan isn't just about building wealth, investing wisely, or budgeting effectively—it’s also about protecting your financial future. One essential but often overlooked component of financial planning i...

Details

????️ Which Life Insurance Is Best for You? Let's Break It Down.When it comes to life insurance, one size definitely does not fit all. Whether you're a fresh college grad, a parent of three, or nearing retirement, your life stage, financial goals, and personal responsibilities all play a huge ...

Details

The Origins of the Case-Shiller Index The foundation of the Case-Shiller Home Price Index began with the pioneering work of its three creators. Their objective was to develop a reliable, repeatable method for tracking home prices using real transaction data. This led to the formation of a compa...

Details

Understanding BTC/USD’s Parabolic Rally: What It Means for Traders Bitcoin (BTC/USD) is experiencing a strong rally, following a well-defined parabolic curve. This pattern is especially visible on a logarithmic chart, which better represents Bitcoin’s large percentage moves over time. Trade...

Details

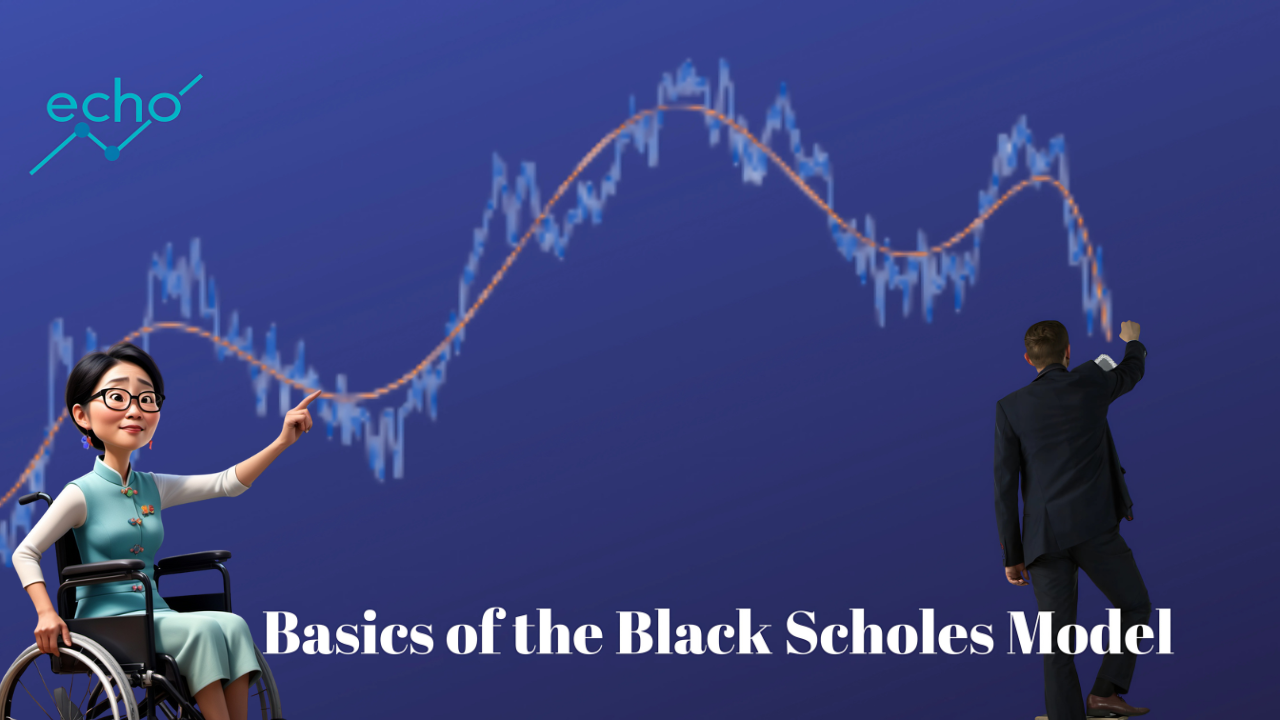

Understanding the Black-Scholes Model: A Foundation of Option Pricing The Black-Scholes model, also known as the Black-Scholes-Merton model, is one of the most important breakthroughs in modern finance. Developed by Fischer Black, Myron Scholes, and later expanded by Robert Merton, this model p...

Details

Understanding Call Options: A Powerful Tool for Investors In the world of investing, a call option is a financial derivative contract that gives the holder the right, but not the obligation, to buy an underlying asset (such as a stock, index, or commodity) at a predetermined price (the strike p...

Details

⚖️ Mastering the Risk Reversal Strategy in Options Trading Options trading extends far beyond the basic buy-and-hold strategies most investors know. While purchasing calls and puts can be profitable, the real opportunity lies in combining these instruments strategically. One such advanced techn...

Details

Understanding Put Options: A Smart Strategy for Risk Management In the world of investing, a put option is a derivative contract that grants the holder the right, but not the obligation, to sell an underlying asset (such as a stock, ETF, or commodity) at a predetermined strike price before or o...

Details

Index Funds: A Smart Investment for Long-Term Financial Success Investing is a crucial part of building financial success, and index funds have become one of the most popular ways to grow wealth over time. Whether you’re just starting or refining your investment strategy, understanding how in...

Details

Stock Warrants: Unlocking Investment Opportunities In the world of investing, stock warrants are powerful derivative securities that grant the holder the right—but not the obligation—to purchase shares of a company’s stock at a fixed price (exercise price) before a specified expiration da...

Details

???? Unlocking the Secrets of Investment Yields! Making Your Money Work for You — One Return at a Time ????When it comes to investing, it’s not just about where you put your money — it’s about how well your money performs once it’s there. That’s where investment yields step in. Wheth...

Details

Understanding the 52-Week Low vs. 52-Week High in Investing: A Key Indicator for Smart Decision-Making When analyzing a stock or other financial asset, one of the most referenced indicators is the 52-week range, which includes the 52-week low and the 52-week high. These figures are essential co...

Details

???? Understanding Company Valuation: Finding Hidden Gems in the Market Smart Investors Don’t Guess — They Calculate ???? When you walk into a store, you want to know you’re getting value for your money. The same principle applies in the stock market. Whether you're buying shoes or s...

Details

Understanding Your Debt Ratio: A Key to Financial Success When it comes to achieving financial stability, one of the most overlooked—but essential—tools is understanding your debt-to-income ratio (DTI). Whether you earn a little or a lot, knowing where you stand with your debt ratio can sha...

Details

???? Top 10 Easiest Secrets to Boost Your Financial SuccessFinancial success isn't reserved for the wealthy elite or those with advanced degrees in finance. The truth is, anyone can dramatically improve their financial situation by implementing simple, proven strategies that require nothing more tha...

Details

Exploring Different Types of Banks: Which One Is Right for You? When it comes to managing your finances, choosing the right bank can have a significant impact on your financial health and convenience. With so many different types of banks available today, it can be difficult to decide which one...

Details

???? FDIC Insurance Limits and How to Maximize Coverage: A Complete Guide to Protecting Your AssetsIn today's volatile financial landscape, understanding Federal Deposit Insurance Corporation (FDIC) insurance limits is crucial for safeguarding your hard-earned capital, emergency funds, and retiremen...

Details

???? Interest Rates Explained: A Complete Guide in Simple TermsInterest rates are the heartbeat of our entire financial ecosystem, influencing everything from your mortgage payments and credit card balances to your investment portfolio performance and retirement savings growth. Yet despite their mas...

Details

Unlocking the Secrets of Stock Types: Your Complete Guide to Investment Success The stock market represents one of the most powerful wealth-building vehicles in modern finance, but not all securities are created equal. Understanding the fundamental differences between various stock types, equity in...

Details

Key Technical Indicators for Smart Investing To interpret stock charts effectively, investors use technical indicators to analyze price movements and identify buy and sell signals. 1. Moving Averages (MA & EMA) ✔ Simple Moving Average (SMA) – Calculates the average stock price...

Details

Intangible Assets: How They Can Boost Your Financial Success When people think about building wealth, they often focus on tangible assets like cash, real estate, and stocks. However, intangible assets—things you can’t physically touch—can be just as valuable, if not more. From intellectua...

Details

How to Leverage Your Inheritance for Long-Term Success Receiving an inheritance can significantly impact your financial future—but only if managed wisely. Many people squander inherited wealth due to poor planning. Here’s how to make it work for you: 1. Don’t Rush to Spend It It...

Details

How Are Dividends Disbursed? Dividends are typically paid quarterly, but some funds or companies pay them monthly or annually. Investors can receive dividends in the following ways: ✔ Dividend Reinvestment Plan (DRIP) – Automatically reinvests dividends into additional shares, leveragi...

Details

How to Be Friends with the IRS (Yes, Really!) Let’s be honest—when you hear “IRS,” your first thought probably isn’t about making friends. But believe it or not, the Internal Revenue Service has a growing social media presence, and they might just be the most unexpected connection you...

Details

???????? Bear and Bull Markets: The Ultimate Guide to Market Cycles and Investment StrategiesUnderstanding market cycles represents one of the most crucial skills in successful investing and wealth management. Bull markets and bear markets define the rhythm of financial markets, influencing investme...

Details

Invite Friends & Colleagues

Post On