???????? Bear and Bull Markets: The Ultimate Guide to Market Cycles and Investment StrategiesUnderstanding market cycles represents one of the most crucial skills in successful investing and wealth management. Bull markets and bear markets define the rhythm of financial markets, influencing investme...

Details

How to Be Friends with the IRS (Yes, Really!) Let’s be honest—when you hear “IRS,” your first thought probably isn’t about making friends. But believe it or not, the Internal Revenue Service has a growing social media presence, and they might just be the most unexpected connection you...

Details

How Are Dividends Disbursed? Dividends are typically paid quarterly, but some funds or companies pay them monthly or annually. Investors can receive dividends in the following ways: ✔ Dividend Reinvestment Plan (DRIP) – Automatically reinvests dividends into additional shares, leveragi...

Details

How to Leverage Your Inheritance for Long-Term Success Receiving an inheritance can significantly impact your financial future—but only if managed wisely. Many people squander inherited wealth due to poor planning. Here’s how to make it work for you: 1. Don’t Rush to Spend It It...

Details

Intangible Assets: How They Can Boost Your Financial Success When people think about building wealth, they often focus on tangible assets like cash, real estate, and stocks. However, intangible assets—things you can’t physically touch—can be just as valuable, if not more. From intellectua...

Details

Key Technical Indicators for Smart Investing To interpret stock charts effectively, investors use technical indicators to analyze price movements and identify buy and sell signals. 1. Moving Averages (MA & EMA) ✔ Simple Moving Average (SMA) – Calculates the average stock price...

Details

Unlocking the Secrets of Stock Types: Your Complete Guide to Investment Success The stock market represents one of the most powerful wealth-building vehicles in modern finance, but not all securities are created equal. Understanding the fundamental differences between various stock types, equity in...

Details

???? Interest Rates Explained: A Complete Guide in Simple TermsInterest rates are the heartbeat of our entire financial ecosystem, influencing everything from your mortgage payments and credit card balances to your investment portfolio performance and retirement savings growth. Yet despite their mas...

Details

???? FDIC Insurance Limits and How to Maximize Coverage: A Complete Guide to Protecting Your AssetsIn today's volatile financial landscape, understanding Federal Deposit Insurance Corporation (FDIC) insurance limits is crucial for safeguarding your hard-earned capital, emergency funds, and retiremen...

Details

Exploring Different Types of Banks: Which One Is Right for You? When it comes to managing your finances, choosing the right bank can have a significant impact on your financial health and convenience. With so many different types of banks available today, it can be difficult to decide which one...

Details

Understanding Liens: How They Can Impact Your Financial Success A lien is a powerful legal claim that can have major financial consequences for individuals and businesses. Whether you’re buying a home, applying for a loan, or trying to build financial stability, understanding liens is crucial...

Details

The Social Security Administration: Understanding Its Role and How to Work with Them The Social Security Administration (SSA) plays a crucial role in the lives of millions of Americans. Whether you’re approaching retirement, applying for disability benefits, or seeking assistance for family ...

Details

Refinancing Your Home: Advantages, Disadvantages, and When It’s BeneficialRefinancing your home can be an appealing option for many homeowners looking to take advantage of lower interest rates, tap into home equity, or change their loan terms. However, like any financial decision, refinancing ...

Details

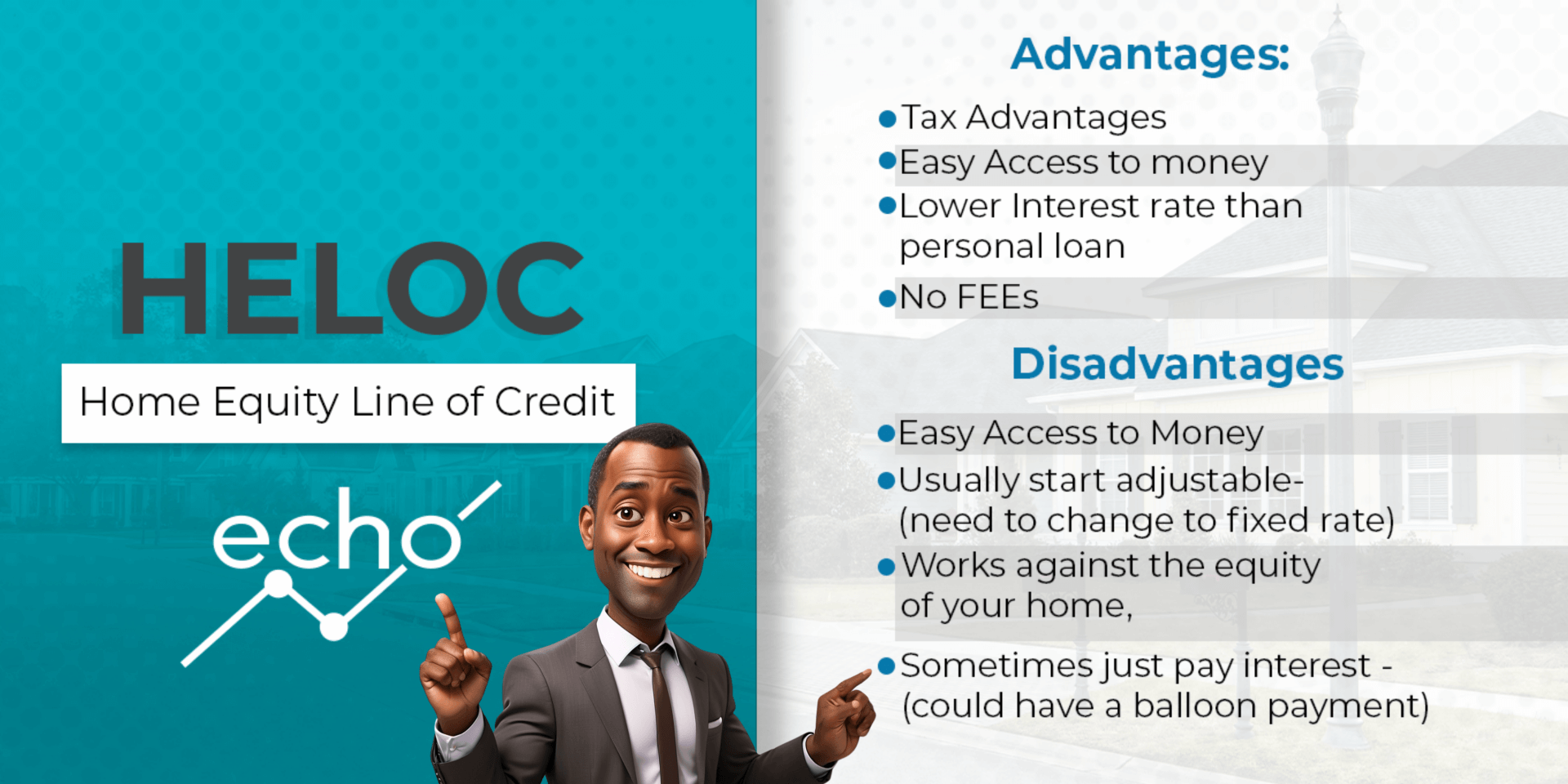

HELOC Tips: Pros and Cons for Your Financial Success PlanA Home Equity Line of Credit (HELOC) can be a powerful financial tool, offering homeowners access to funds for major expenses, home improvements, or even debt consolidation. But is it the right move for your financial success plan? Let’s ...

Details

Invite Friends & Colleagues

Post On